Nestled amid the towering Rockies, Colorado is a state blessed with over 300 days’ worth of sunshine each year. Coupled with its cool climate, the state is the perfect candidate for solar energy.

But harvesting the plentiful sunshine for energy isn’t just about placing panels on rooftops.

There’s so much more to consider, and understandably, our clients at 8760 Solar have a lot of questions.

If you’re a farmer or agricultural producer in Colorado who is considering going solar, this guide is tailor-made for you!

We delve into topics ranging from government incentives and tax credits to whether solar is a better investment than farm equipment. We also cover the different types of solar installations, the best place to install them, and much more in this buyer’s guide.

- Rising Energy Costs in Colorado: How Much Will You Pay in the Future?

- Why Choose a Solar Installation Over New Farm Machinery?

- Incentives and Tax Credits for Solar in Colorado

- Solar Installation Depreciation

- Net Metering in Colorado: What It Is and How It Works

- Farm and Agricultural Solar Installation Types

- Solar Array Placement and Why It Is Important

- Solar Operations and Maintenance (O&M)

- How Solar is Helping San Luis Valley and the Rest of CO

Rising Energy Costs in Colorado: How Much Will You Pay in the Future?

When it comes to energy bills, farms, and businesses have had it rough. The state currently ranks 20th out of 52 states for the most expensive electricity bills.

This is mainly because it relies heavily on natural gas for energy, which has soared in cost recently. And, of course, the utility companies pass this cost onto the consumer.

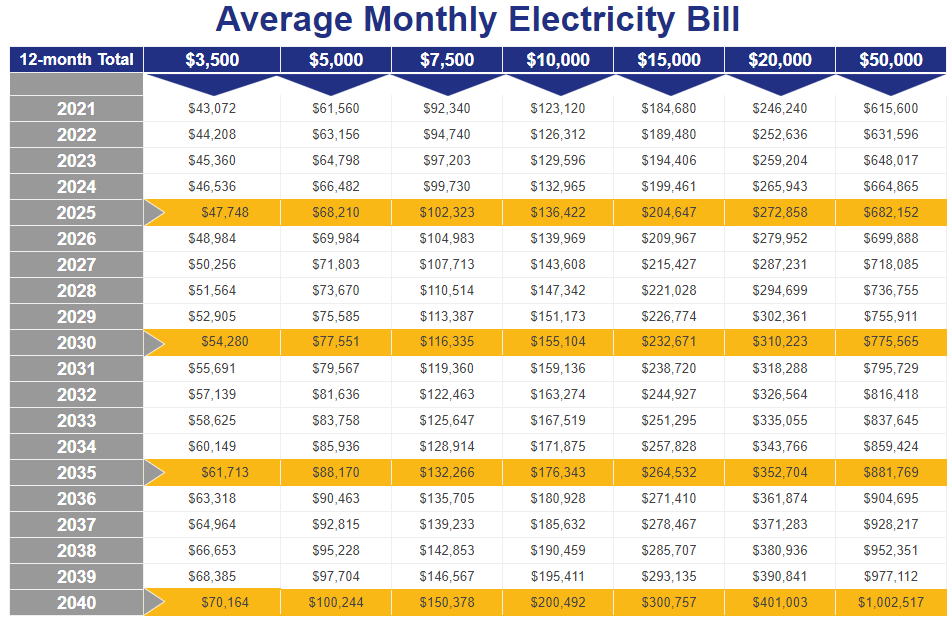

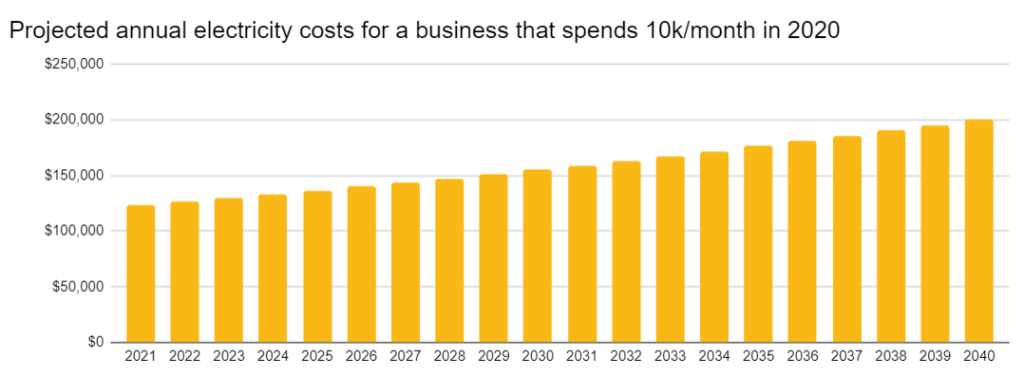

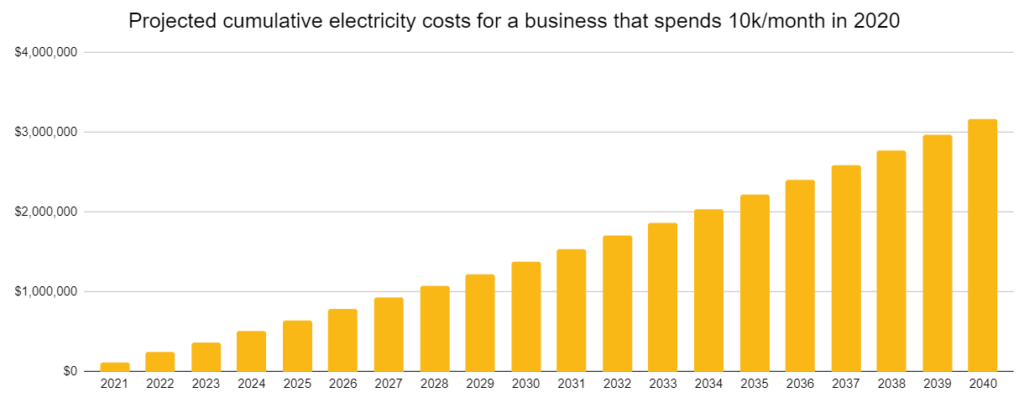

Furthermore, energy prices have always been on a steady incline and if they continue on the current trajectory, Colorado farmers can look forward to the following:

- Many farmers will pay over $2 million for their electricity over the next 20 years;

- If a farmer currently pays $10,000 a month, they can expect to pay over $155,000/year in 2030 and over $200,000/year in 2040, respectively;

Why Choose a Solar Installation Over New Farm Machinery?

After a profitable year, the go-to investment tends to be the purchase of new farm machinery.

It’s reliable, fast, and efficient, and gets the job done without you having to worry about costly repairs or downtime.

Yet, there’s a catch. The moment you roll out that new tractor or combine harvester onto your fields, its value starts to drop. In fact, within five years, most farm machinery can depreciate to about 50% of its initial cost. So, if reselling is on your mind, you’re likely to recover only a fraction of your original investment.

So, instead of investing in farm machinery, how about investing in solar energy instead? You can easily get back more than 100% return on investment (ROI) in the first year alone, and that’s on top of the potential 96% savings off the cost of your energy bills.

Take a look at this example.

You want to spend $1 million on new farm machinery:

| Machinery total cost | $1,000,000 |

| Expense off income (33%) | $330,000 |

| 1st-year depreciation | $100,000 |

| Cost of machinery after tax incentives | $570,000 |

| ROI | 57% |

A 57% first-year ROI isn’t bad but let’s now compare it to a solar installation that costs $1,250,000:

| Solar installation total cost | $1,250,000 |

| ITC tax credit of 30% | $330,000 |

| Colorado Enterprise Zone tax credit of 3% | $100,000 |

| 1st-year depreciation of 33% | $350,625 |

| USDA REAP grant of 50% | $625,000 |

| Total amount of incentives | $1,388,125 or 116% |

| Money gained installing solar after incentives | $138,125 |

| ROI | 111% |

That’s an ROI of 111% in the first year! And don’t forget about the continuous savings on your energy bills for the next 25 – 30 years.

Incentives and Tax Credits for Solar in Colorado

USDA Rural Energy for America Program (REAP) Grant (USA-Wide)

This is a multi-billion dollar fund specifically for farmers and rural businesses to invest in renewable energy systems. The current scheme is available to apply in 2023 and 2024 (final application date September 30, 2024); after which the rules and budget may change.

Applicants can apply for:

- A grant for up to 50% of the cost of a solar power installation, capped at $1 million,

- A loan guarantee for up to 75% of the total eligible project cost of installing solar arrays, or

- A combined grant and loan guarantee funding of up to 75% of the total cost.

Federal Solar Tax Credit (USA-Wide)

Businesses that purchase a solar installation can enjoy two tax credits once a solar system has been installed:

- 30% investment tax credit (ITC): Calculated as a percentage of the cost of the installed system.

- 2.75 ¢ per kWh production tax credit (PTC): A per kilowatt-hour (kWh) tax credit for electricity generated.

Additional bonus credits can be earned if the project meets the qualifying criteria:

- Domestic content bonus: Additional 10% if qualified

- Energy Community Bonus: Additional 10% if qualified

- Low-Income Bonus: Additional 10% if qualified

Colorado Enterprise Zone Program

Businesses that build solar installations in any of the 16 designated zones in Colorado where economic stimulation is encouraged can potentially qualify for the following:

- Enterprise Zone Investment Tax Credit: This is a 3% tax credit for business personal property development investment.

- Enterprise Zone Research and Development Tax Credit: New technology investments (e.g., solar installations) are classified as research and development and are therefore eligible for a 3% tax credit.

Solar Installation Depreciation

You can gain a 28% – 33% depreciation off your taxes. How much exactly depends on your existing tax bracket. To understand more about depreciation and how it affects your business taxes, have a chat with your CPA.

Net Metering in Colorado: What It Is and How It Works

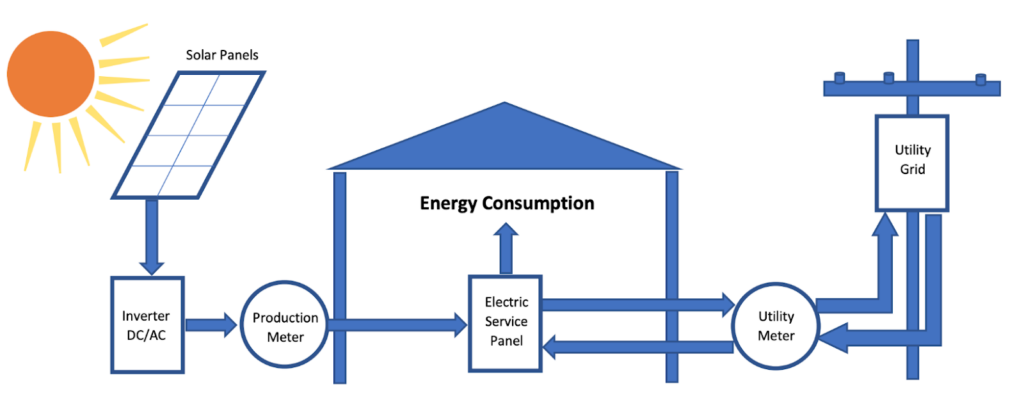

During daylight hours, you will find that your solar panels produce enough energy for you to fulfill your consumption needs. You will also find that the panels produce more energy than you actually need.

Rather than waste it, the excess energy is sent to the grid, and in exchange, you get credits that you can use every time you need to draw power from the grid.

Colorado is one of the best states for sending excess power to the grid because it operates on what’s known as a “true net-metering” basis. Essentially, for every kWh worth of energy that you send to the grid, you receive a credit for 1kWh worth of grid energy in return.

Then, during times when your solar panels aren’t producing energy and you need to draw power from the grid, you can use your accumulated credits.

The amount of energy you can exchange depends on your utility company:

- For the two investor-owned utility companies (Xcel and Black Hills Energy), you can exchange 25kW worth of energy on a residential meter, and up to 500kW for commercial.

- The requirement is that you are limited to installing a solar system that can produce a maximum of 120% of your regular energy usage.

- For San Luis Valley Rural Electric (and most other coops and municipal utilities), the amount you can exchange is capped at 10 kWh for residential systems and 25 kWh for industrial systems.

- To qualify for interconnection, the meter must have at least three month’s worth of usage.

- The 120% rule doesn’t apply and for larger energy users you may not be able to cover 100% of your usage.

Other states have less advantageous policies such as net billing and time-of-use rates. This means those who send energy to the grid get far less in return than if the state had net metering in place.

Solar Battery Storage vs Net Metering

Battery storage is becoming increasingly popular in states that don’t have net metering in place.

This is where the excess energy produced by solar panels gets sent to a battery instead of the grid. When energy is required and none is coming from the solar panels, the user draws from the battery instead.

Since Colorado has net metering, having a battery is not necessary unless you need one to power any off-grid systems. This includes things like irrigation systems and cabins that are off the electricity grid.

If you think you may need battery storage, talk with your 8760 Solar developer to explore the different options.

Farm and Agricultural Solar Installation Types

Solar is incredibly versatile and can be placed in many places and in a variety of ways. Your developer will work with you to explore the most suitable possibilities, but in most cases, farms work best with ground-mounted or roof-mounted solar panels.

Farming and Solar Coexistence

Agrivoltaics is the advantageous practice of using the same piece of land for solar energy and farming and it is starting to gain popularity in the US.

For example, the land around solar panels can be used for grazing sheep. This has the added advantage of lowering maintenance costs since the sheep keep the surrounding vegetation in check.

You can also grow shade-tolerant crops under and around solar panels. The protection from the sun protects the crops and increases groundwater retention, which results in a more bountiful harvest and reduced watering costs.

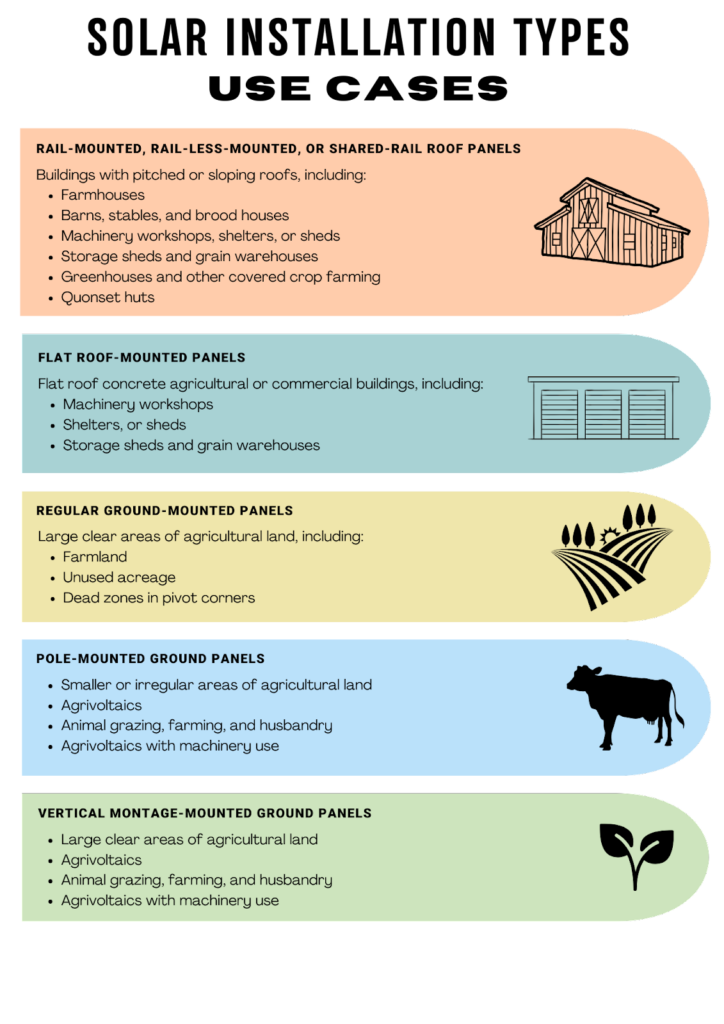

Here’s a quick overview of the different types of solar installation types and what they are best for:

Solar Array Placement and Why It Is Important

As a farmer, you have access to a lot of land but not all of it is suitable for a solar array. To get the most from your solar panels, the key is to find an area that provides as much access to direct sunlight as possible. Here’s what you should know.

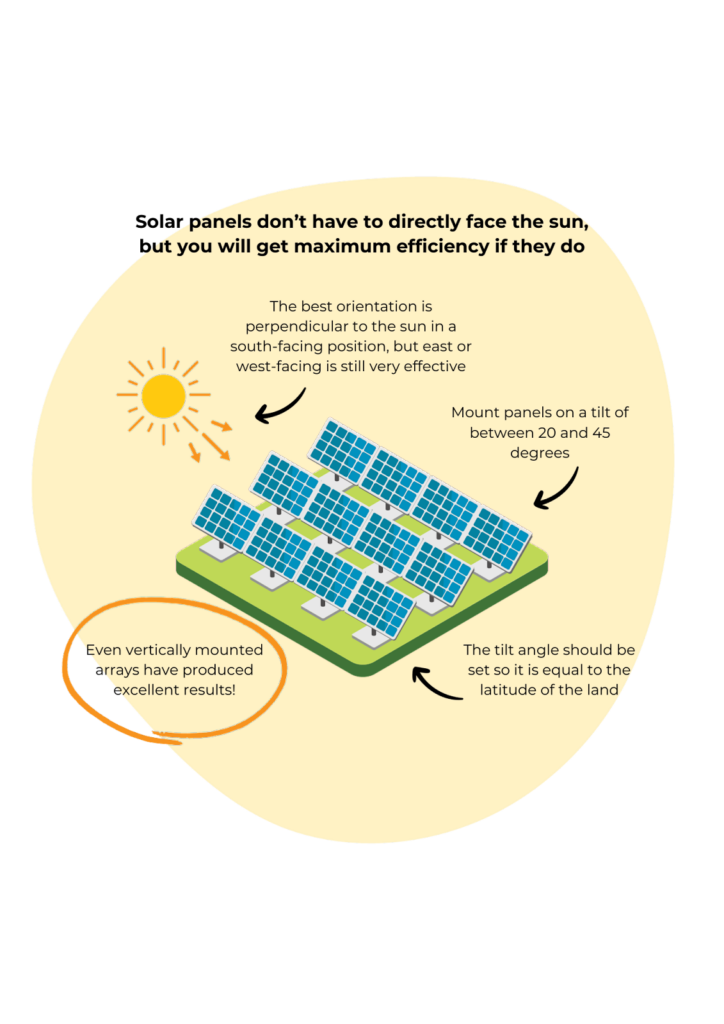

What Is the Best Orientation and Angle for a Solar Array?

What Are the Considerations for Farm Solar Array Placement?

- Avoid shaded or partially shaded areas as much as possible. To get the best results, solar panels need around five hours of direct sunlight per day.

- Panels don’t need to be installed next to each other. If you have several smaller suitable areas, the panels can be placed in them.

- Check and adhere to local zoning and setback rules. In some cases, a zoning permit may be required.

- Never place solar panels underneath overhead power lines.

- For safety and shade avoidance, install panels at least 50ft from buildings and trees.

- To help manage costs, place solar panels no further than 100ft from where the inverter is housed or 300ft from the meter box.

- You must gain “right of way” permission from The Colorado Department of Transportation (CDOT) to install solar cabling over or under asphalt or bitumen county roads. In most cases, this is too expensive and difficult to achieve, so it’s best avoided.

- Areas prone to flooding should be avoided as this presents the need to mount the panels higher off the ground, resulting in increased costs.

- Sheep make excellent grazing companions for solar panels. Other livestock, such as cows and horses, should not be kept with solar panels as they are likely to damage them.

- Wildlife doesn’t present a problem or danger for solar panels, so it is unnecessary in most cases to fence them off.

- To avoid increased maintenance, place solar panels away from farming activity that creates a lot of dust and debris.

- Roofs should be less than 40 years old and sturdy enough to take the increased weight (factor 2-6 pounds per square foot or 2 tonnes for a 25kWh system).

- A roof installation must adhere to the International Fire Code’s requirements.

Solar Operations and Maintenance (O&M)

A top concern for farmers considering solar is the amount of maintenance required for a solar system. After all, time is precious and no one wants to spend a lot of it making sure their solar panels are working properly.

The great news is that solar systems require very little maintenance and rarely break down. Therefore, very little time is required to keep them in top condition.

Overall, here’s what you should be doing to maintain a solar system:

- Regularly check energy bills for sudden changes

- Consider a wifi solar monitoring system

- Solar annual panel cleaning

- Keep vegetation in check

- Visual inspections to spot anything amiss.

- Professional service every 2 years

The Benefits of Fixed Tilt Solar Racking

Tracking systems that automatically tilt the panels in accordance with the sun’s position do slightly increase the solar panel’s efficiency but they have the disadvantage of being more expensive to install and maintain.

Tracking systems are run on electricity and, therefore, have a lot more wiring and moving parts than a fixed system, dramatically increasing the likelihood of a fault or problem occurring.

For example, if an object such as a tree branch gets wedged in the tracking system, this can quickly cause it to malfunction and even break down.

Because of this, at 8760 Solar, we use fixed non-moving systems because our clients prefer the lower maintenance needs and the reduced costs that come with it.

How Solar is Helping San Luis Valley and the Rest of CO

Notable San Luis Valley and CO Agrovoltaics Solar Projects

There are two notable solar farms that have been installed in San Luise Valley, as well as two exciting examples of agrivoltaics farms in Colorado that are worth checking out:

- San Luis Valley Solar Ranch: A 35MW farm situated next to Mosca provides energy for 7,500 households.

- Alamosa Solar Project: Built in the San Luis Valley, this 35MW facility was the largest in the world when it was initially constructed in 2012.

- Jack’s Solar Garden: This 1.2 MW Longmonet-based solar project is an excellent example of agrivoltaics, and provides power for over 300 homes while allowing 15 varieties of crops to thrive.

- Garnet Mesa: Planned for Delta County, this 80 MW solar farm will sit on 383 acres and provide enough energy for 18,000 homes while also providing grazing land for approximately 1,000 sheep.

8760 Solar Customer Testimonial

Name: Philip Smartt

Type of farm: Potato and Potato Seed Grower

Location: Monte Vista, CO, 81144, US

“We’ve very much enjoyed working with 8760 Solar. The whole team has been extremely helpful and responsive every step of the way. Plus, they always answer when we call.

Whenever we had questions, especially about the grant application process, the team always took the time to answer them. There were also a few installation hiccups that were resolved quickly and efficiently.

It was also important for us to use local manufacturers and producers for the project. 8760 Solar takes this very seriously and sources its materials from local suppliers and manufacturers as much as possible.

Overall, 8760 Solar was excellent to work with, and we especially appreciate the dedication and responsiveness of the entire team.”