As the push towards green energy continues across the USA, it’s clear that some states are doing far better than others. Making positive steps in sustainable and clean energy sources is a complex and costly process so naturally, some areas of the US are resistant to this change.

Despite being situated in the western US coal region, Colorado is up there and is taking positive action with some impressive green energy policies and targets.

Since 2010, Colorado’s total renewable electricity net generation has more than quadrupled and now accounts for 37% of the state’s total generation. This achievement means that around two-fifths of the state’s electricity net generation came from renewables in 2022.

We’re excited about the future of Colorado’s energy and the role that solar energy plays in it.

There are loads of interesting stats to talk about, so let’s take a deeper look into Colorado’s energy trends and what it’s doing to go green.

In a Nutshell

- Colorado still sources most of its energy from coal and gas.

- All of the state’s coal plants will close by 2031.

- Wind power is the primary source of sustainable energy in Colorado.

- Colorado ranks 12th among US states for solar energy.

- The state aims to use 100% green energy by 2040.

- More than 30 state bills have been passed to accelerate green energy production.

- Guzman is emerging as the winner for wholesale energy, with Tri-State and Xcel both losing business to it.

Colorado’s Current Energy Mix

As of 2022, Colorado gets its electricity from the following sources:

- 37% from coal

- 27% from natural gas

- 29% from wind

- 6% from solar

- 3% from hydroelectric

Colorado and Coal

As we can see, the state still sources most of its power from coal. The state has a long history with this energy source.

It currently ranks 10th for coal production and is part of the western coal mining region (Alaska, Arizona, Montana, Colorado, New Mexico, North Dakota, Utah, Washington, and Wyoming) which collectively accounts for 57% of the USA’s total coal production.

Despite this, the use of coal for electricity generation is declining fast. In 2010, coal-fired power plants accounted for 68% of the state’s total electricity net generation. In contrast, 37% was generated from coal in 2022.

As of 2019, there were eight operational coal-fired power plants (down from 16 plants in 2014). Since then, one has closed down completely, one has converted to natural gas, and the remaining six will either shut down or convert in the coming years.

By 2031, the state will no longer use coal for its energy production.

Here’s when you can expect them to close:

| Power Plant | Owned By | Location | Closure Completion Date |

| Hayden Station | Xcel Energy | Routt County | 2028 |

| Craig Station | Tri-State Generation and Transmission | Moffat County | 2029 |

| Comanche Station | Xcel Energy | Pueblo County | 2031 |

| Ray Nixon Power Plant | Colorado Springs Utilities | El Paso County | 2030 |

| Pawnee Station | Xcel Energy | Morgan County | 2026* |

| Rawhide Energy Station | Platte River Power Authority | Larimer County | 2030 |

Colorado and Natural Gas

While coal production is grinding to a halt, the same can’t be said for natural gas usage.

In 2022, Colorado was the eighth-largest natural gas-producing state. Additionally, it has the eighth largest natural gas reserves across the whole of the US.

There were 29 natural gas plants in Colorado in 2021. This figure has risen and is set to rise further as redundant coal plants convert over to natural gas. It also boasts 38 gas processing facilities with an overall capacity of 6,628 MMcf/d.

The use of natural gas doesn’t seem to be slowing down but it will need to if Colorado is to meet its 2050 clean energy goals.

Furthermore, the cost of natural gas has skyrocketed in the past year. This was due to a large spike in demand and inclement weather, and although prices have since dropped, they are still at an all-time high.

Colorado and Wind Power

Wind is the current renewable champion for Colorado’s renewable energy supply. The state currently ranks 7th for wind power in the US, which is no mean feat.

Wind power has doubled in Colorado since 2010 and now boasts more than 4,800MW of power output.

As of 2022, there were 2,200 wind turbines installed in 38 wind farms, across 11 counties. with one of the largest wind farms in the US. Cedar Creek Wind Farm situated in Weld County (NE Colorado) is one of the largest in the US and plays host to almost 400 turbines. This wind farm alone has the capacity to generate enough power for 70,000 homes.

Xcel and Wind Power

Xcel is investing heavily in wind power and claims it received over 10,000MW of wind power into its system in 2021. This accounted for 21% of its energy output and this is expected to rise to 40% by 2025.

Xcel owns two wind farms in Colorado – Cheyenne Ridge (500MW) and Rush Creek (600MW) – along with 16 additional wind farms in other states. It also purchases 6,300 megawatts of wind power through long-term contracts.

Colorado and Solar Energy

Right now, only 6.83% of Colorado’s electricity is generated from solar, but this is set to increase as more and more large-scale solar projects are announced – particularly from large wholesale energy suppliers.

The state currently ranks 12th in the US for solar energy and this is a huge improvement from last year (2022) when it lagged in at 25th. Colorado also ranks 11th for utility-scale solar power-generating capacity, with 1,294 megawatts installed so far.

So far, Colorado has invested over $6.1 billion into solar energy, resulting in 2,996MW of power output (enough to power almost 600,000 homes).

There are now around 400 solar companies operating in the state and overall, solar has generated over 7,500 jobs.

The growth projection for Colorado’s solar over the coming five years is another 4,084MW, which is fantastic news.

Xcel and Solar in Colorado

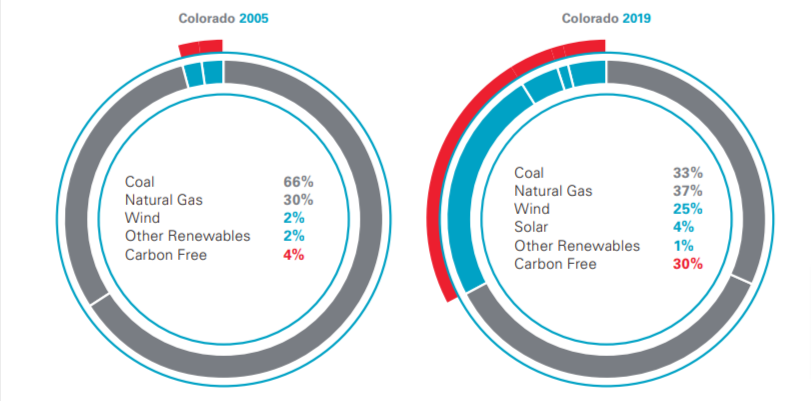

Image credit: Xcel 2019 clean energy future report

Xcel has not put as much effort into solar as it has wind power. However, it is starting to make strides in this area. Currently, the wholesale supplier gets 4% of its energy from solar energy production.

Right now, Xcel has enough solar to power 200,000 homes but that’s across all states it serves – not just Colorado.

It has a couple of utility-scale solar projects up its sleeve – the Western Mustang Solar Project in Wisconsin and the Sherco Solar Project in Minnesota. However, there doesn’t seem to be any solar action from Xcel in Colorado – yet. Let’s hope that changes!

Tri-State and Solar in Colorado

Tri-State doesn’t go into a great deal of detail about its renewable energy sources. However, it is expanding its reach into solar energy and currently has six solar projects in the pipeline, five of which are located in Colorado:

- Dolores Canyon Solar, Dolores County: 110MW opening in 2024

- Spanish Peaks Solar, Las Animas County: 100MW opening in 2025

- Axial Basin Solar, Moffat County: 145MW opening in 2024

- Coyote Gulch Solar, Montezuma County:140MW opening in 2025

- Spanish Peaks Solar II, Las Animas County: 40MW opening in 2025

Guzman and Solar in Colorado

Guzman is a new(ish) energy wholesaler and is busy disrupting the entire industry. While it’s not clear what its energy mix percentages are (Guzman declined to provide this information) we do know that it is doing a lot of exciting work in solar.

So far, its notable solar endeavors include:

- Enabled major utility company Kit Carson to source 100% of its daytime electricity from solar energy.

- Has partnered with Delta-Monrose to build the Garnet Mesa solar project in Colorado which will provide enough solar power for 18,000 homes plus provide grazing space for over 1,000 sheep.

- A partnership with Sonnedix has secured the development of the 110-megawatt Sonnedix Solar Fountain project in El Paso County. This is due to come online in 2025.

- Has released Yampa Valley Utilities from its contract with Xcel and greatly increased the amount of independent energy it can produce. This opens up the possibility of many solar projects in the area.

- Most recently, Guzman has agreed to purchase 100% of the power generated from the 140 MW Shallow Basket solar farm based in New Mexico.

Colorado’s Green Energy Targets

Governor Jared Polis has set some impressive clean energy targets for Colorado. The Polis administration’s roadmap is ambitious and aims to reach 100% renewable energy by 2040.

In 2021 more than 30 bills were passed to accelerate the green energy transition and outline the following greenhouse gas reduction goals to be achieved by 2030:

- 80% reduction from electricity generation

- 60% from oil and gas development

- 40% from transportation

- 20% from industry and buildings

Where solar is concerned, there are a number of interesting developments to help meet these targets:

- Bill HB21-1284 imposes a limit on the aggregate of all fees for solar installations. The limit is $500 for residential installations and $1,000 for commercial installations.

- Bill SB21-261 increases the allowed size of distributed generation facilities to 200% (currently cannot exceed 120% of usage) and allows a customer to indefinitely carry ALL monthly credits forward without expiring.

- Bill SB21-261 also increases the allowed size of on-site renewable energy installations to 1MW (doubled from 500MW).

- Additionally, Bill SB21-261 creates a standard offer program for customer-owned solar making it simpler to connect solar. It also limits the program to 0.25 percent of the utility’s previous year’s retail sales. (land must be located within the utility’s service territory).

- Bill HB21-1105 allows dedicated funds from fuel assistance payments to help eligible customers go solar.

Colorado’s Winners and Losers in the Race for Green Energy

There’s no doubt the future of energy is changing drastically. Understandably, some major utility companies and wholesale providers have been resistant to this change since it largely means investing billions of dollars into clean energy sources and updating crumbling infrastructure.

What has emerged so far are some clear winners and losers in the race for sustainability, so let’s take a look at who these are.

Xcel Energy: Biggest Loser

Xcel is the major player for energy in Colorado. However, it’s not doing so well right now.

The chief complaints about Xcel include sky-high energy prices and its inability to produce a consistent supply of energy. CORE Electric Cooperative has had enough and is suing Xcel for breach of contract over the 700 days of downtime its Pueblo coal-fired power plant has suffered since it went online in 2010.

CORE has since departed Xcel for wholesale energy and has taken up a contract with Invergy and Onward Energy.

Sick of the sky-high prices and the cap on using self-produced energy, the following utility companies have also parted ways with Xcel and have signed contracts with Guzman Energy:

- Arkansas River Power Authority (Holly, La Junta, Lamar, Las Animas, Springfield, and Trinidad)

- Grand Valley Power

- Yampa Valley Electric

Xcel Energy Breakdown

Xcel’s energy mix currently looks like this:

- 23% from coal

- 24% from natural gas

- 33% from wind

- 13% from nuclear

- 3% from other renewables

Colorado specific:

- 27% from coal

- 31% from natural gas

- 35% from wind

- 5% solar

- 2% from other carbon-free sources

Xcel owns eight coal plants – all of which are scheduled for closure, ten natural gas plants, and two nuclear plants.

Where renewables are concerned, its focus is on wind farms with 18 on its portfolio. It is also increasing its interest in solar energy with several utility-scale projects outside of Colorado in the pipeline.

Tri-State: Also Losing Out to Guzman Energy

Tri-State – Colorado’s major wholesale supplier for utility co-ops – has been dealt significant blows recently and has lost out majorly to Guzman Energy.

The chief complaints from its co-ops are that the rates are too high, the 50-year contracts are too long (with unaffordable exit fees), and the requirement to purchase 95% of required energy from Tri-State stifles the ability to develop renewable energy projects.

So far, the co-ops that have jumped ship from Tri-State to Guzman are:

- Kit Carson

- United Power

- Delta Monrose Electric Association

Outside of Colorado, Northwest Rural Public Power District and Mountain Parks Electric have both also announced they plan to leave Tri-State in 2025.

Tri-State Energy Breakdown

Tri-State’s current energy breakdown looks like this:

- 33% from coal

- 22% from natural gas

- 33% from renewables (breakdown by type unclear)

- 12% other contracts

It owns at least eight coal plants, a number of natural gas plants, and only one single solar farm (though more are due to go online soon). Overall, a staggering 96.53% of its energy is sourced from non-renewables.

Tri-State plans to achieve a 100% reduction in CO2 emissions from coal generation in Colorado by 2030 but aside from the handful of solar farms and closing down its coal plants, it hasn’t outlined precisely how it intends to achieve this.

Guzman Energy: Colorado’s Winning Wholesale Energy Provider

As you have probably guessed by reading this article, Guzman has made some serious waves in the energy supply industry. Tri-State and Xcel must be reeling from the loss of business to Guzman, especially since it has only been around since 2014.

One of the biggest draws for utility companies is the greatly increased cap on self-produced energy. Tri-State and Xcel cap this as little as 3% whereas Guzman allows up to 20%.

This paves the way for many more solar and wind projects as smaller utility companies finally have the capacity to accommodate the extra energy sent to the grid.

Right now, Guzman keeps its cards close to its chest and doesn’t disclose its energy mix percentages so it’s unclear how much it obtains from renewables vs. dirty sources.

But what we do know is that Guzman is a force to be reckoned with. It has invested heavily in a number of notable solar projects and seems intent on stealing dissatisfied customers away from the major players in wholesale energy.

We will be watching what Guzman continues to do with a very keen eye!

Conclusion

So far Colorado is doing pretty well in its quest to go carbon-neutral. And thanks to Guzman and aggressive government targets, things are finally starting to gain momentum in the right direction.

There has never been a better time to go solar and new opportunities are presenting themselves every day. From excellent government tax credits and incentives to the amazing savings you can achieve on your energy bills, solar is surprisingly affordable.

At 8760 Solar, we’re on hand to answer your questions and get you on board with solar energy. Text “READY” to 719 470-0254 or get in touch via email: sales@8760solar.com – we’d love to talk with you!

Frequently Asked Questions

What Is the Target for Greenhouse Gases in Colorado?

Colorado has committed to reducing overall greenhouse gas emissions by at least 25% by 2025, 50% by 2030, and 90% by 2050.

Is Colorado Going Green?

Colorado is doing its best to go green. The current Polis administration released its Greenhouse Gas Pollution Reduction Roadmap roadmap in 2021 which outlines over 30 bills to accelerate the production of renewable energy and cut emissions by 90% by 2050.

What Is the Best Renewable Energy Source for Colorado?

Currently, wind power is the best renewable energy source in Colorado and makes up 29% of its total energy production. Solar makes up 6% while hydroelectric is 3%.

Which State Is the Leader in Renewable Energy?

Texas is the current leading state for renewable energy with 136,827mWh produced annually.