Ever since the Inflation Reduction Act (IRA) was signed into law back in August 2022, it seems like everyone is talking about solar energy and considering going solar.

This is great news and is really helping to speed up the USA’s transition to green energy and a more sustainable future.

But the road is not as smooth as it could be. Despite the numerous incentives and tax credits available, solar projections didn’t quite hit the mark in the latter part of 2022. So, what’s needed to steer the solar market back on course?

Let’s dive into the details to unravel this.

In a Nutshell

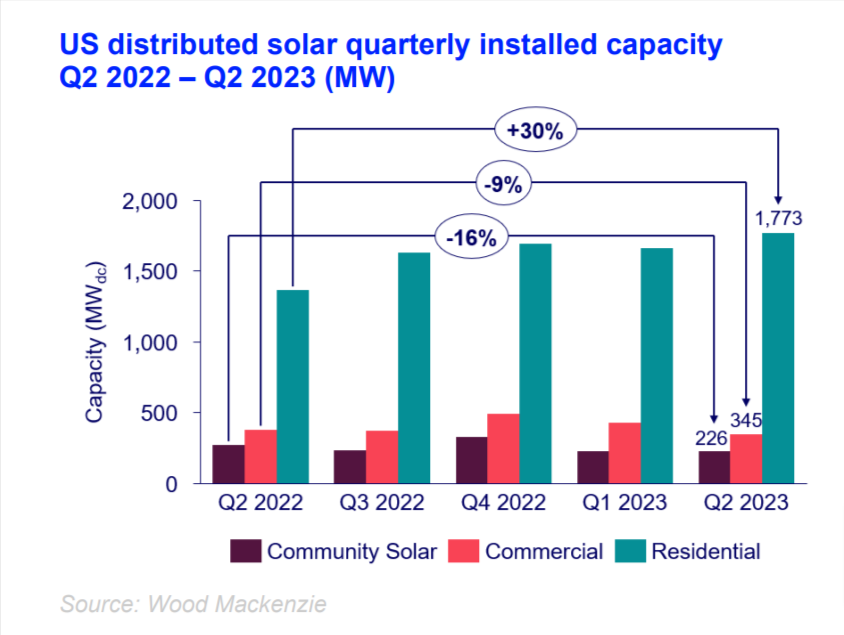

- Residential solar has increased by 30% in the past year, while commercial solar projects have decreased by 9%.

- The rise in residential solar is driven by the backlog of Californian NEM2 customers and a dip in solar retail rates.

- Soaring interest rates are making it difficult for customers to obtain funding for solar projects.

- Supply chain issues and long wait times for equipment stem from import regulatory changes and investigations, and shortages for transformers and microchips.

- Lack of US solar manufacturing and reliance on Chinese imports also contribute to supply chain issues, however, this is set to change rapidly as solar manufacturers clamor to set up shop on US soil.

- The Inflation Reduction Act and REAP grants mean there are few barriers to farmers for going solar.

- Despite drawbacks, the uptake of solar energy will continue to soar in the US.

Why Is Residential Solar on a Downward Trend?

According to a 2022 report published by Wood Mackenzie and the Solar Energy Industries Association (SEIA), solar hasn’t grown as everyone thought it would.

Residential solar took quite a dip in Q1 2023 but is set to finish strong by the end of the year. Overall, it’s 30% up on what it was a year ago. However, this is largely due to the reduced retail rates of solar installations and the large backlog of installations that were created under California’s NEM 2.0 (a more favorable net billing policy than the current NEM3).

As installations in California ease off and the retail prices for solar rise in 2023, the national residential market is forecast to contract by 4% and by 38% in California itself.

Additionally, community and commercial solar projects are down by 16% and 9% respectively.

Source: Wood Mackenzie

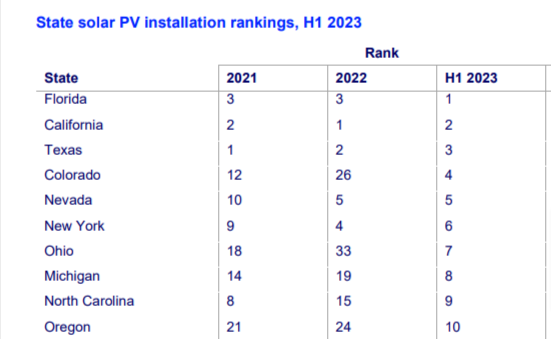

In the report, we can also see that during 2022, Colorado took a significant dip in the number of solar installations and dropped to 26th place out of all states, but by the end of the first half of 2023, it had soared to 4th place.

This is fabulous news for Colorado, but it doesn’t mean we should ignore the stumbling blocks that are or have been making it more challenging to get solar energy installed.

Here are the key reasons why.

Soaring Interest Rates

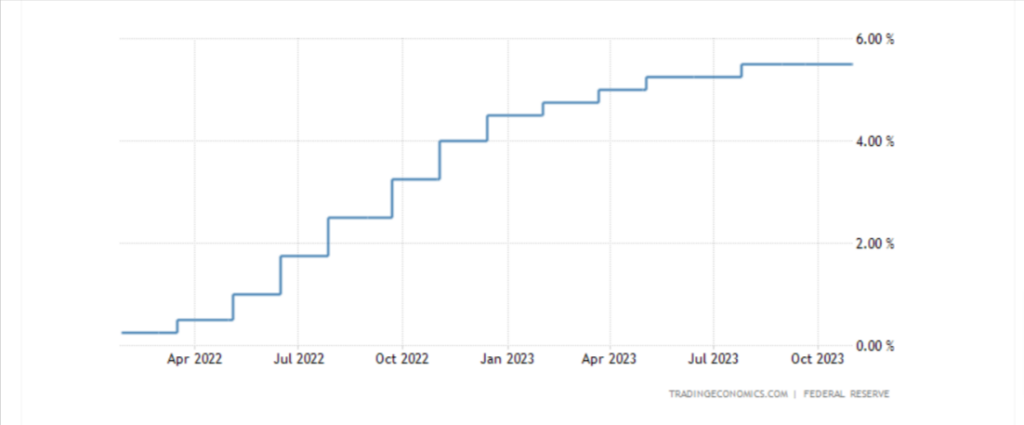

Source: Trading Economics

In an effort to curb inflation, federal interest rates have tripled since Q1 2022, which makes taking out loans unattainable and unaffordable for many. After all, what’s the point of borrowing capital to save money on energy bills if the repayments are going to cripple you?

The high interest rates have had more of an impact on the residential solar market and slowed down its growth quite a lot. This was so significant that in January 2023, major bank Barclays actually downgraded the stock values of Sunrun, SunPower, and Enphase Energy.

This rise in interest rates affected commercial and utility-scale solar projects too and as a result, there were 40% fewer solar installs in 2022 when compared with 2021.

Interest rates remain high, and while this has managed to keep inflation at bay, it will continue to create problems, particularly in the residential sector.

Farmers and agricultural businesses shouldn’t be so concerned here as they can take advantage of the USDA’s Rural Energy for America Program (REAP) grant, which can cover up to 50% of the cost of a solar installation (100% of 8760 Solar’s clients who applied for the grant have been successful).

Coupled with the numerous tax incentives and credits, it’s possible to get a 100%+ return on investment within the first year alone.

Regulatory Changes and Concerns

Two regulatory constraints have played their parts in slowing down the production of solar energy components.

First, the Uyghur Forced Labor Protection Act (UFLPA), which took effect in June 2022, saw more than 1,000 solar equipment shipments being detained in US ports or even diverted into other markets.

Due to concerns and evidence that the region uses slave labor and has active concentration camps, the UFLPA bans imports from the Xinjiang Uyghur Autonomous Region of the People’s Republic of China if it cannot be proved that slave labor wasn’t used to manufacture exported goods.

The act forces buyers in the US to provide transparent supply chain mapping to prove that no workers were subjected to forced labor. Coming up with supply chain transparency took time and it was a while before the detained solar equipment was able to start being released.

However, even though shipments started being released in December 2022 and the supply chain was expected to reach normalcy during mid-2023, it’s going to take a little while for the solar market to catch up.

A second key constraint was the U.S. Department of Commerce (DOC) tariff investigation on anti-dumping circumvention. This investigation aims to confirm whether imports of crystalline silicon photovoltaic cells are bypassing existing anti-dumping and countervailing duties on Chinese solar modules and cells. The possibility of additional tariffs, potentially applied retroactively to 2021, poses a further disruption to the solar supply chain.

The investigation has already had a negative impact on the solar supply chain, and the possibility of additional tariffs, potentially applied retroactively as far back as 2021, poses a further disruption to the solar supply chain.

The Biden Administration has addressed this problem somewhat and has announced that no anti-dumping tariffs will be applied to solar cell imports that come directly from Cambodia, Malaysia, Thailand, and Vietnam, but the existing tariffs for Chinese and Taiwanese imported equipment will remain in effect.

Equipment Sourcing Issues

One of the most significant problems for large commercial and utility-scale solar projects is the inability to source the right components to complete the installs.

The biggest problem has been finding transformers. The price of these skyrocketed to up to triple the cost of what it was in 2020 and wait times for the equipment have also soared to over a year. Now, the average wait time for a transformer is between 20 – 39 months.

This problem is so bad that a group of lawmakers is urging the government to use $2.1 billion of disaster supplemental funding to address the situation.

However, nothing has been confirmed yet, and until it is, this issue won’t let up any time soon.

Additionally, a microchip shortage that occurred during the COVID-19 pandemic is still having a knock-on effect on the solar industry. Inverters – which contain microchips – started to result in long wait times for the equipment to be produced and delivered to those who ordered it.

As of early 2023, the wait time for a semiconductor chip stood at around 26 – 52 weeks. This is incredibly long but amazingly an improvement over the wait times experienced in 2022 and 2021.

The government is trying to improve the situation by introducing the CHIPS Act, which has provided around $52 billion for the research and development of manufacturing semiconductor chips in the USA and about $24 billion in tax credits for chip manufacturers who base themselves on US soil.

This aims to stimulate and increase this industry in the USA and reduce our reliance on Chinese chip imports.

US Manufacturing Limitations

Currently, the demand for solar equipment far surpasses the manufacturing capacity of the USA, and our reliance on Chinese imports is causing problems and supply-chain disruptions.

The good news is that this is changing rapidly as more and more solar manufacturers are cropping up all over the US. This is mostly due to the introduction of the Inflation Reduction Act which has paved the way and made it easier for solar manufacturing plants to set up shop.

For example, JA Solar, Cubic PV, First Solar, Qcells, Philadelphia Solar, Enel, and Adion Solar have all announced their intention to start producing solar modules domestically. Existing solar manufacturers in the US have also announced plans to expand or ramp up production over the coming months and years.

This is fabulous news for the future of solar but it will take a while for the positive effects to be felt. Rome wasn’t built in a day and neither is a solar production plant. Once a manufacturing plant starts being constructed, there is roughly a 12-18 month wait before it becomes operational.

However, according to the Wood Mackenzie report referenced at the start of the article, if all the proposed manufacturing facilities are realized, the US would be able to increase its solar capacity from 10.6 GW to 108.5 GW.

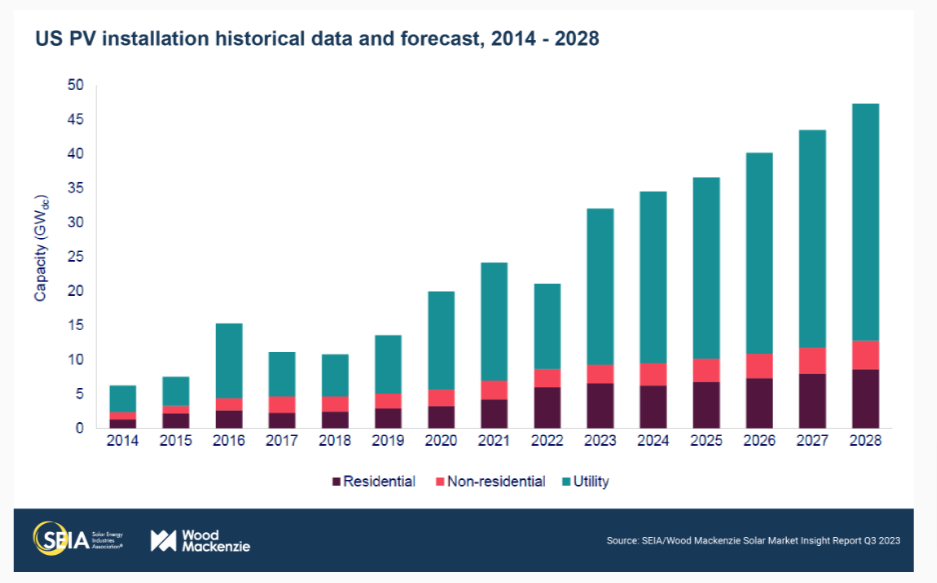

Why We Shouldn’t Worry About the Solar Downtrend

It’s true, there are problems. But nearly all of them are being addressed in some way or another. And as the supply chain issues ease up, things are only going to get better and the forecasts show that solar is set to soar in the next five years.

The main sticking point is the high interest rate which doesn’t seem like it’s going to drop any time soon. This will continue to cause restrictions in the take up of residential solar installations as homeowners typically have to rely on financing to pay for it.

As a result, we’re likely to see power purchase agreements and solar leasing become more commonplace.

And what about our Coloradan farmers and agricultural businesses?

Well, with the REAP grant in place, the numerous tax incentives, and the ability to deduct solar as a business expense, it has never been more affordable to invest in solar energy.

Really, the only thing you have to worry about is the potential wait times for equipment, but this is set to become less of an issue as manufacturing increases within the USA.

Should you wait to get solar?

We don’t think so. There have never been as many incentives to go solar as there are now. Plus, Colorado gets to enjoy true net metering, maximizing your investment even more.

And who knows when these incentives may be reduced or even removed altogether? We say, strike while the iron is hot and you can get over 100% ROA in the first year of your solar installation’s operation.

Talk to 8760 Solar

If you’re wondering where to start, talk to us! Our team at 8760 Solar is backed up with years of experience in providing solar energy for Colorado’s rural businesses.

After an initial chat, we can run a full analysis of your farm and advise you on the best system for your needs. Then, we’ll arrange the whole installation, from obtaining permits to ordering equipment, installing it, and beyond.

To kick things off, text “READY” to 719 470-0254 or contact us via email: sales@8760solar.com. We’re looking forward to speaking with you.

Frequently Asked Questions

Is Solar a Good Investment During a Recession?

Solar energy is one of the safest and best investments you can make during a recession. This is because its ability to reduce energy bills by 98% will save you a substantial amount of money over the coming decades.

What Is the Future Trend in the Solar Power Industry?

Solar energy is set to become the world’s largest producer of electricity by 2050 and the US is poised to triple its solar output within the next five years. Exciting solar innovations include the integration of photovoltaic materials into buildings, making the possibilities of solar energy harvesting endless.

Does Solar Have a Good Future?

Solar has an excellent future. Governments are keen to push their countries towards a sustainable energy future, and solar plays a huge role in that. Significant efforts are being made to improve solar technology to gain even higher efficiencies and reduce production costs, making the energy source more accessible for all.

What Is the New Technology in Solar Panels 2023?

One of the key areas of research in solar technology is finding ways to increase their efficiency. Multiple research groups have found a way to increase efficiency to over 30% by using perovskite in conjunction with silicon. Additionally, organic photovoltaic polymers offer new ways to integrate solar technology into building materials such as transparent solar windowpanes.

How Long Will Solar Last?

A new solar installation typically comes with a warranty that guarantees operation for at least 25 years. However, good-quality monocrystalline solar panels can easily last up to around 40 years if cared for properly, although they will drop slightly in efficiency over time.