The 30% Investment Tax Credit (ITC) is already a very attractive proposition and will no doubt persuade many businesses to make the transition into solar energy.

But did you know there are bonuses to be had as well?

That’s right, on top of the 30% ITC, you can also get a 10% Domestic Content Bonus, bringing the total tax credit up to a whopping 40%!

While this is fantastic news for anyone considering making the jump over to solar, you should also understand that qualifying for the bonus currently isn’t as easy as it should be. This is because the distinction between what is and isn’t considered US-made is murky, and it’s currently very difficult or often impossible to find a manufacturer or supplier that can provide qualifying materials.

That said, we hope that the confusion surrounding this bonus will be made clearer in the coming months and the process for qualifying will be made easier. Right now, it’s a case of “watch this space” to see what happens.

Let’s jump into the details so you can understand how you can qualify and take advantage of this bonus.

- What Is the Domestic Content Bonus?

- Which Products and Components Are Included?

- How Do You Qualify for the Domestic Content Bonus?

- How To Calculate the Domestic Content in Your Manufactured Products

- What Are the Challenges Surrounding This?

- Which Suppliers Are Committing to Supplying US-Made Products?

- How to Apply for the Bonus

- Final Thoughts

- Frequently Asked Questions

What Is the Domestic Content Bonus?

The Domestic Content Bonus is an additional 10% ITC awarded when a solar installation is found to contain a sufficient percentage of materials, products, and components mined, manufactured, or produced in the United States.

The point of this is to encourage businesses to use US-made products rather than sourcing them from overseas while strengthening clean-energy supply chains across the country. The idea is that if project developers are rewarded, they are more likely to prioritize the use of products made on US soil.

The bonus itself was created by the Inflation Reduction Act, which was signed into law by President Biden in August 2022. The act is designed to tackle climate change and promote the adoption and use of clean and sustainable energy by providing almost $400 billion worth of federal incentives to convince people to make the switch.

Which Products and Components Are Included?

Domestic content refers to three main products:

- Steel products

- Iron products

- Manufactured products

In relation to solar installations, steel and iron products refer to the module racking, foundational rebars, and pile or ground screws.

Manufactured products include photovoltaic (PV) cells, modules, trackers, and inverters, as well as the following, if applicable:

- Backrail or mounting frame

- Glass

- Encapsulant

- Junction box

- Backsheet

- Adhesives and edge seals

- Pottants

- Bypass diodes

- Bus ribbons

Note: This list is not exhaustive and may include other items.

Here are the components and categories at a glance:

| Component | Category |

| Photovoltaic module racking | Steel and iron |

| Foundational rebars | Steel and iron |

| Pile and ground screws | Steel and iron |

| Photovoltaic module and associated components | Manufactured product |

| Photovoltaic tracker | Manufactured product |

| Inverter | Manufactured product |

How Do You Qualify for the Domestic Content Bonus?

The qualification criteria are simple, but tricky to achieve currently.

First, you must ensure you qualify for the ITC. If you don’t, you cannot get the Domestic Content Bonus. To understand more about the ITC, you can read about it on the energy.gov website.

Next, your solar installation must consist of 100% US-produced steel and iron. Even if you miss this criterion by just 1%, you won’t get the bonus. However, this is the easy part as the US produces plenty of steel and iron solar foundational products currently.

For manufactured products, US suppliers are few and far between. For the bonus, each product must contain at least the following percentages of US-made components:

- Projects that begin before 2025: 40%

- Projects commencing in 2025: 45%

- Projects commencing in 2026: 50%

- Projects that begin in 2027 and beyond: 55%

So, in 2023, if your solar installation consists of 100% US-made steel and iron, and the manufactured products contain at least 40% US-made components, you will qualify for the bonus.

How To Calculate the Domestic Content in Your Manufactured Products

While it’s pretty easy to determine how much steel and iron was produced in the US, it’s a trickier process working out what percentage of the manufactured products were created in the US.

The most important thing to understand is the distinction between direct and indirect costs of manufacturing components. Direct costs include direct labor and material costs, whereas indirect costs include overheads, electricity, maintenance, and so on.

- If a product contains 100% US-made components, then both the direct and indirect costs of the product are considered;

- If a product contains a mix of US-made and non-US-made components, then only the direct costs of the US-made components are considered.

To understand better how this works, here’s an example:

- You have two manufactured products within a PV system, both of which were made in the USA:

- Product A cost $200 total and has two components, both made in the USA;

- Product B cost $400 total and has three components, two of which were made in the USA while the third one was made overseas.

Now, let’s take a look at the direct costs for each component:

| Products | Direct Cost | US manufactured | |

| Product A cost: $200 | |||

| Component 1 | $60 | Yes | |

| Component 2 | $90 | Yes | |

| Total Direct Cost | $150 | ||

| Product B cost: $400 | |||

| Component 1 | $60 | Yes | |

| Component 2 | $100 | Yes | |

| Component 3 | $200 | No | |

| Total Direct Cost | $160 |

Now, because product A was manufactured in the USA in its entirety, the entire cost of the product counts. This includes the direct and indirect manufacturing costs totaling $200 ($150 direct costs + $50 indirect costs).

For product B we only include the direct costs for components one and two ($60 and $100). We don’t include the direct cost of component three because it was made overseas, and in this case, we don’t include the indirect costs, either.

- Now we add these together: $200 + $60 + $100 = $360

- The total cost of the two products together was $600

$360 is 60% of $600. Therefore, our total domestic content is above the required criteria of at least 40% and will qualify for the Domestic Content Bonus.

What Are the Challenges Surrounding This?

In principle, calculating the percentages for products is straightforward as long as you know where and how each component was made. But this is where things get murky and difficult.

One of the chief complaints around the qualifying percentages is that it’s tough and sometimes even impossible to work them out. There are several stumbling blocks commonly encountered:

- Developers are finding it challenging to get manufacturers to reveal their costs (direct and indirect);

- Manufacturers may not even have an accurate breakdown of this information;

- It’s necessary to certify or verify the country of origin for components that manufacturers are reluctant to provide;

- Developers will expect manufacturers to pay damages should the IRS conduct an audit and find the information inaccurate.

To add to the issue, developers are currently finding that the manufacturers who do provide proof of domestic content are charging a premium for the privilege. Ultimately, this makes the entire solar installation project increase in price, which can then negate any savings gained from the bonus.

You do have a chance to have your say, though, and get things changed to make it easier – and cheaper – for everyone concerned. The rules surrounding qualifying criteria are not set in stone. Notice 2023-38 of the Domestic Content Bonus Credit Guidance states that at around the start of 2024, the Treasury will set the final requirements.

Both developers and manufacturers can use this window of time before the end of 2023 to contact the Treasury and make their concerns heard.

Which Suppliers Are Committing to Supplying US-Made Products?

Currently and unfortunately, the list of suppliers is almost non-existent, and it’s not always clear if the products qualify for the domestic content bonus despite the manufacturer claiming they are 100% US-made.

According to our research, Alencon – a solar DC optimizer manufacturer, creates products that contain between 75% – 100% domestic content and states on its website that its products qualify for the bonus. However, you’ll quickly understand that this is just one product of a solar array, and while Alencon may qualify, other products may not.

Solar panel manufacturers such as Auxin, Convalt Energy, Crossroads Solar, Meyer Burger, Mission Solar, Q Cells, Solar4America, and Solar Max Tech make big statements about how their products are 100% US-made. However, dig a little deeper, and you find that this typically means the products are assembled in the USA – not necessarily created. And none of these companies can state that their products qualify for the bonus…yet.

We’re hoping that as the demand for truly US-manufactured and made solar products increases, the number of suppliers will also increase. And since the US government is pushing for cleaner, greener energy solutions, this may make suppliers act faster.

How to Apply for the Bonus

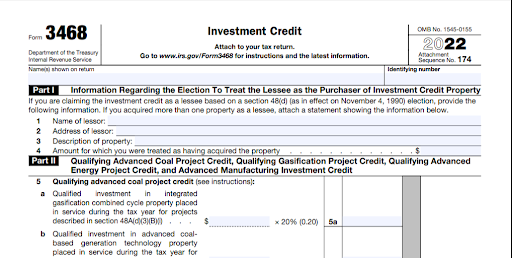

To claim the ITC and the Domestic Content Bonus, you must complete and submit form 3468 along with a statement containing the following information:

- The type and category of the project

- The address of the project, including geographical coordinates

- The date the installation was placed in service

- The total Domestic Content Bonus Credit amount in the first taxable year in which it is reported

- Any supporting information

The statement must also be signed by someone who holds legal authority.

Final Thoughts

Along with the 30% ITC, this 10% bonus credit is great news for anyone currently considering a solar installation. And, since agricultural and commercial installations tend to cost a high amount, 10% can add up to a serious number of dollars.

The issue remains, however, that it is currently extremely difficult to find suppliers that qualify. Rest assured that we’re keeping a close eye on how this progresses and that we’ll inform you of any updates.

If you need more info about solar, feel free to get in touch with our team at 8760 Solar. We’re tried and trusted experts in providing solar solutions to farming, agricultural, and commercial businesses and are perfectly placed to advise you on your perfect solar system.

Call or email us; we’re always excited to talk to potential new customers about their needs and the excellent benefits of solar:

Call or email our team today

(719) 470-0254

Frequently Asked Questions

What Is the Domestic Content Requirement for ITC?

The current requirements for domestic content qualification require that 100% of steel and iron products and at least 40% of other products and components are manufactured in the USA.

The percentage requirement for components will start to rise from 2025 onwards.

What Is the Bonus Credit Amount for Domestic Content?

The bonus credit amount for domestic content is an additional 10% on top of the investment tax credit.

Is the Solar Tax Credit Going Down in 2023?

The solar tax credit is not going down in 2023. It has actually risen to 30% and will remain at this level for the next ten years.